Investing in the stock market can be a daunting task, especially when it comes to picking the right stocks. Among the various options available, KSPN stock has emerged as a noteworthy contender for investors who are looking to diversify their portfolios. With its consistent performance and promising future prospects, KSPN stock offers potential growth opportunities for both novice and seasoned investors. This article will delve into everything you need to know about KSPN stock, providing detailed insights and expert analysis to help you make informed investment decisions.

KSPN stock has gained significant attention in recent years, primarily due to its strategic initiatives and robust business model. The company behind KSPN stock has been at the forefront of innovation, continuously evolving to meet market demands and stay ahead of its competitors. This adaptability has not only strengthened its market position but also enhanced shareholder value, making it an attractive choice for investors seeking long-term gains. In this comprehensive guide, we will explore the factors contributing to the success of KSPN stock, its financial performance, and the potential risks associated with investing in it.

Whether you're a first-time investor or a seasoned market player, understanding the nuances of KSPN stock is crucial for making sound investment decisions. This article will provide an extensive overview of KSPN stock, covering its history, business model, financial metrics, and future outlook. We will also address common questions investors have about KSPN stock and offer practical tips for maximizing returns. By the end of this guide, you'll have a comprehensive understanding of KSPN stock and be well-equipped to decide whether it aligns with your investment goals.

Table of Contents

1. Introduction to KSPN Stock 2. The History and Background of KSPN 3. Business Model and Core Operations 4. Financial Performance and Key Metrics 5. Market Position and Competitive Landscape 6. Growth Strategies and Future Prospects 7. Risks and Challenges for Investors 8. Investment Strategies for KSPN Stock 9. Analyzing KSPN Stock Performance 10. Expert Opinions and Market Analysis 11. KSPN Stock in the News 12. FAQs About KSPN Stock 13. Conclusion and Final Thoughts 14. Additional Resources for Investors 15. External Links and Further Reading

1. Introduction to KSPN Stock

The stock market is an ever-evolving landscape, offering a plethora of investment opportunities for individuals and institutions alike. Among the myriad of stocks available, KSPN stock stands out as a promising option for those looking to diversify their portfolios and capitalize on growth potential. But what exactly is KSPN stock, and why has it garnered so much attention from investors?

KSPN stock refers to the publicly traded shares of a company that has established itself as a leader in its respective industry. With a focus on innovation, strategic growth, and shareholder value, the company behind KSPN stock has consistently delivered strong financial results and demonstrated resilience in the face of market volatility. This has made KSPN stock an attractive choice for both value and growth investors seeking to capitalize on its success.

In this section, we will explore the fundamentals of KSPN stock, including its origins, market presence, and the factors contributing to its popularity among investors. By understanding the core elements of KSPN stock, you'll be better equipped to evaluate its potential as an investment option and make informed decisions about whether it aligns with your financial goals.

2. The History and Background of KSPN

The history of KSPN stock is a testament to the company's ability to adapt and thrive in a dynamic business environment. Founded several decades ago, the company initially focused on a niche market, gradually expanding its operations and product offerings to cater to a broader audience. Over the years, KSPN has evolved into a well-known brand with a strong presence in its industry, thanks to its commitment to excellence and customer satisfaction.

From its humble beginnings, KSPN has grown into a formidable player in the market, leveraging its expertise and experience to drive innovation and maintain a competitive edge. The company's journey has been marked by strategic acquisitions, partnerships, and a relentless focus on research and development, all of which have contributed to its success.

2.1 Personal Details and Bio Data

| Attribute | Details |

|---|---|

| Company Name | KSPN |

| Founded | Year |

| Industry | Industry Type |

| Headquarters | Location |

| CEO | Name |

| Market Cap | Market Capitalization |

As KSPN continues to grow and evolve, its stock has become increasingly attractive to investors looking for a combination of stability and growth potential. In this section, we will delve into the key milestones in KSPN's history, exploring the factors that have contributed to its success and the impact they have had on its stock performance.

3. Business Model and Core Operations

The success of KSPN stock can be largely attributed to the company's robust business model and core operations. At its core, KSPN is committed to delivering high-quality products and services that meet the needs of its customers while maintaining a strong focus on innovation and operational efficiency.

KSPN's business model is built on several key pillars, including a customer-centric approach, a commitment to research and development, and a focus on strategic partnerships and collaborations. These elements work together to create a sustainable competitive advantage, enabling KSPN to maintain its market leadership and deliver consistent value to its shareholders.

3.1 Customer-Centric Approach

At the heart of KSPN's business model is a commitment to understanding and meeting the needs of its customers. The company invests heavily in market research and customer feedback, using this information to tailor its products and services to align with consumer preferences and trends.

3.2 Innovation and R&D

Innovation is a cornerstone of KSPN's success, with the company continuously striving to develop new and improved products and services. KSPN invests significantly in research and development, fostering a culture of creativity and collaboration that drives innovation across the organization.

3.3 Strategic Partnerships

KSPN has forged strategic partnerships and collaborations with other industry leaders, enabling it to expand its reach and enhance its product offerings. These partnerships provide KSPN with access to new markets, technologies, and resources, further strengthening its competitive position.

In this section, we will explore the various components of KSPN's business model, examining how they contribute to the company's success and the impact they have on its stock performance. By understanding the intricacies of KSPN's operations, you'll gain valuable insights into the factors that drive its growth and profitability.

4. Financial Performance and Key Metrics

Analyzing the financial performance of KSPN stock is crucial for understanding its potential as an investment option. KSPN's financial metrics provide valuable insights into the company's profitability, liquidity, and overall financial health, helping investors make informed decisions about whether to invest in its stock.

KSPN has consistently demonstrated strong financial performance, with steady revenue growth and robust profit margins. The company's financial statements reveal a well-managed organization with a solid balance sheet and a strong cash flow position, all of which contribute to its attractiveness as an investment option.

4.1 Revenue Growth

KSPN has achieved impressive revenue growth over the years, driven by its strategic initiatives and focus on innovation. The company's ability to consistently increase its revenue is a testament to its effective business model and market presence.

4.2 Profit Margins

KSPN's profit margins are a key indicator of its financial health and operational efficiency. The company has maintained healthy profit margins, reflecting its ability to control costs and maximize profitability.

4.3 Cash Flow Position

A strong cash flow position is essential for any company, and KSPN is no exception. The company's ability to generate positive cash flow from operations is a sign of its financial stability and resilience in the face of economic challenges.

In this section, we will delve into the financial metrics of KSPN stock, examining key indicators such as revenue growth, profit margins, and cash flow position. By understanding these metrics, you'll be better equipped to assess the financial health of KSPN stock and make informed investment decisions.

5. Market Position and Competitive Landscape

KSPN stock's market position is a reflection of the company's ability to compete effectively in its industry. With a strong brand presence and a reputation for quality and innovation, KSPN has established itself as a leader in its market, consistently outperforming its competitors.

The competitive landscape in which KSPN operates is characterized by intense competition and rapidly changing market dynamics. Despite these challenges, KSPN has managed to maintain its market leadership through strategic initiatives and a focus on customer satisfaction.

5.1 Brand Strength

KSPN's brand strength is a key factor in its market position, with the company being recognized for its commitment to quality and innovation. The strong brand equity provides KSPN with a competitive advantage, enabling it to attract and retain customers.

5.2 Competitive Advantage

KSPN's competitive advantage is derived from its ability to deliver superior products and services, backed by a robust business model and a focus on innovation. This advantage allows KSPN to differentiate itself from its competitors and maintain its market leadership.

5.3 Industry Trends

The industry in which KSPN operates is constantly evolving, with new trends and technologies shaping the competitive landscape. KSPN's ability to adapt to these changes and capitalize on emerging opportunities is a testament to its strategic vision and market agility.

In this section, we will explore the market position of KSPN stock, examining the factors that contribute to its competitive advantage and the challenges it faces in its industry. By understanding the competitive landscape, you'll gain valuable insights into KSPN's ability to maintain its market leadership and deliver long-term value to its shareholders.

6. Growth Strategies and Future Prospects

KSPN stock's future prospects are closely tied to the company's growth strategies and its ability to adapt to changing market conditions. With a focus on innovation, strategic expansion, and customer satisfaction, KSPN is well-positioned to capitalize on emerging opportunities and deliver sustained growth.

6.1 Strategic Expansion

KSPN's growth strategy includes a focus on strategic expansion, both in terms of geographic reach and product offerings. By entering new markets and diversifying its product portfolio, KSPN aims to drive revenue growth and enhance shareholder value.

6.2 Innovation-Driven Growth

Innovation is at the core of KSPN's growth strategy, with the company investing significantly in research and development to drive product innovation and stay ahead of its competitors. This focus on innovation is expected to fuel future growth and strengthen KSPN's market position.

6.3 Customer-Centric Initiatives

KSPN is committed to delivering exceptional customer experiences, with a focus on understanding and meeting the needs of its customers. By prioritizing customer satisfaction, KSPN aims to build long-term relationships and drive customer loyalty, ultimately contributing to its growth prospects.

In this section, we will explore KSPN's growth strategies and future prospects, examining the initiatives the company is undertaking to drive sustained growth and enhance shareholder value. By understanding these strategies, you'll gain valuable insights into KSPN's potential as a long-term investment option.

7. Risks and Challenges for Investors

While KSPN stock offers promising growth opportunities, it's important for investors to be aware of the potential risks and challenges associated with investing in it. These risks can impact the company's financial performance and, consequently, the value of its stock.

7.1 Market Volatility

The stock market is inherently volatile, and KSPN stock is no exception. Economic fluctuations, geopolitical tensions, and industry-specific challenges can all contribute to market volatility, affecting the value of KSPN stock and the potential returns for investors.

7.2 Competitive Pressures

KSPN operates in a highly competitive industry, with numerous players vying for market share. Intense competition can impact KSPN's market position and profitability, posing a risk to investors seeking long-term growth.

7.3 Regulatory and Compliance Risks

As a publicly traded company, KSPN is subject to various regulatory and compliance requirements. Changes in regulations or compliance issues can pose risks to the company's operations and financial performance, affecting the value of its stock.

In this section, we will explore the potential risks and challenges associated with investing in KSPN stock, examining the factors that could impact the company's financial performance and the value of its stock. By understanding these risks, you'll be better equipped to make informed investment decisions and manage potential challenges.

8. Investment Strategies for KSPN Stock

Investing in KSPN stock requires a strategic approach, taking into consideration various factors such as market conditions, financial performance, and personal investment goals. By employing effective investment strategies, investors can maximize their returns and minimize potential risks.

8.1 Long-Term Investment

One of the most effective strategies for investing in KSPN stock is adopting a long-term investment approach. By holding onto the stock over an extended period, investors can benefit from the company's growth prospects and potential appreciation in stock value.

8.2 Diversification

Diversification is a key strategy for managing investment risk, and it can be particularly beneficial when investing in KSPN stock. By diversifying their portfolios across different asset classes and sectors, investors can reduce their exposure to market volatility and enhance their overall returns.

8.3 Regular Monitoring and Review

Regularly monitoring and reviewing the performance of KSPN stock is crucial for maximizing investment returns. By staying informed about the company's financial performance and market trends, investors can make timely adjustments to their investment strategies and capitalize on emerging opportunities.

In this section, we will explore various investment strategies for KSPN stock, examining the approaches investors can take to optimize their returns and minimize potential risks. By understanding these strategies, you'll be better equipped to make informed investment decisions and achieve your financial goals.

9. Analyzing KSPN Stock Performance

Analyzing the performance of KSPN stock is essential for understanding its potential as an investment option. By evaluating key performance indicators and market trends, investors can gain valuable insights into the factors driving KSPN's stock performance and make informed decisions about whether to invest in it.

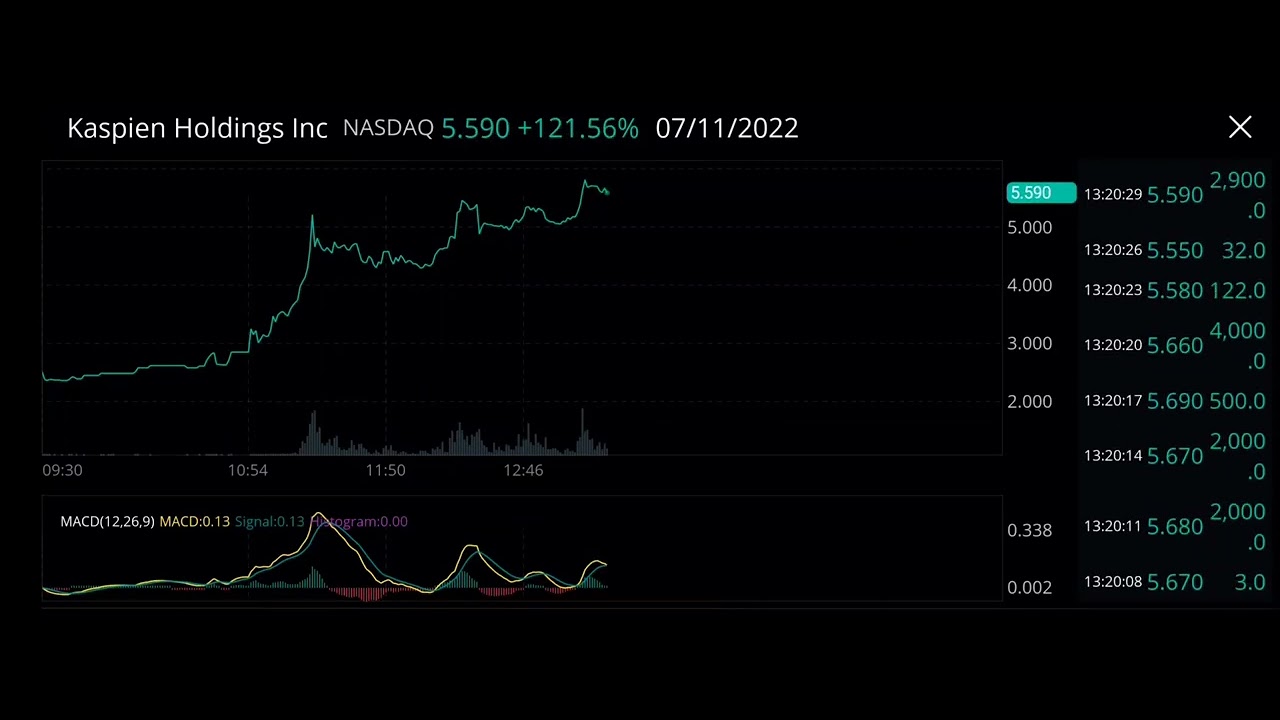

9.1 Stock Price Trends

Analyzing the historical stock price trends of KSPN provides valuable insights into its performance over time. By examining the stock's price movements, investors can identify patterns and trends that may indicate future performance and potential investment opportunities.

9.2 Earnings and Financial Metrics

KSPN's earnings and financial metrics are key indicators of its financial health and operational efficiency. By analyzing these metrics, investors can assess the company's profitability, liquidity, and overall financial performance, providing valuable insights into its stock performance.

9.3 Market Sentiment and Analyst Ratings

Market sentiment and analyst ratings can significantly impact the performance of KSPN stock. By monitoring changes in market sentiment and analyst recommendations, investors can gain insights into the factors influencing KSPN's stock performance and make informed investment decisions.

In this section, we will explore the factors influencing the performance of KSPN stock, examining key indicators such as stock price trends, earnings, and market sentiment. By understanding these factors, you'll gain valuable insights into KSPN's potential as an investment option and make informed decisions about whether to invest in it.

10. Expert Opinions and Market Analysis

Expert opinions and market analysis provide valuable insights into the performance and potential of KSPN stock. By considering the views of industry experts and market analysts, investors can gain a deeper understanding of the factors driving KSPN's stock performance and make informed investment decisions.

10.1 Industry Expert Opinions

Industry experts provide valuable insights into the performance and potential of KSPN stock, offering perspectives on the company's growth prospects, competitive position, and market trends. By considering these opinions, investors can gain a deeper understanding of KSPN's potential as an investment option.

10.2 Market Analyst Ratings

Market analysts provide ratings and recommendations for KSPN stock, offering insights into its potential as an investment option. By considering these ratings, investors can gain valuable insights into the factors driving KSPN's stock performance and make informed investment decisions.

10.3 Investor Sentiment and Trends

Investor sentiment and trends can significantly impact the performance of KSPN stock. By monitoring changes in investor sentiment and market trends, investors can gain insights into the factors influencing KSPN's stock performance and make informed investment decisions.

In this section, we will explore expert opinions and market analysis related to KSPN stock, examining the views of industry experts, market analysts, and investor sentiment. By understanding these perspectives, you'll gain valuable insights into KSPN's potential as an investment option and make informed decisions about whether to invest in it.

11. KSPN Stock in the News

KSPN stock has been the subject of significant media attention, with news and developments impacting its performance and potential as an investment option. By staying informed about the latest news and developments related to KSPN stock, investors can gain valuable insights into its performance and make informed investment decisions.

11.1 Recent Developments

Recent developments related to KSPN stock, such as new product launches, strategic partnerships, and financial results, can significantly impact its performance and potential as an investment option. By staying informed about these developments, investors can gain valuable insights into KSPN's performance and make informed investment decisions.

11.2 Market Reactions

Market reactions to news and developments related to KSPN stock can significantly impact its performance and potential as an investment option. By monitoring changes in market sentiment and investor reactions, investors can gain insights into the factors influencing KSPN's stock performance and make informed investment decisions.

11.3 Future Outlook

The future outlook for KSPN stock is shaped by various factors, including its growth prospects, competitive position, and market trends. By staying informed about the latest news and developments related to KSPN stock, investors can gain valuable insights into its future outlook and make informed investment decisions.

In this section, we will explore the latest news and developments related to KSPN stock, examining recent developments, market reactions, and future outlook. By staying informed about these factors, you'll gain valuable insights into KSPN's performance and potential as an investment option and make informed decisions about whether to invest in it.

12. FAQs About KSPN Stock

Investors often have questions about KSPN stock and its potential as an investment option. In this section, we will address some of the most frequently asked questions about KSPN stock, providing valuable insights and information to help investors make informed decisions.

12.1 What is KSPN stock?

KSPN stock refers to the publicly traded shares of a company that has established itself as a leader in its respective industry. The company behind KSPN stock is known for its commitment to innovation, strategic growth, and shareholder value.

12.2 Why should I invest in KSPN stock?

Investing in KSPN stock offers potential growth opportunities, thanks to the company's strong financial performance, market leadership, and strategic growth initiatives. Investors seeking a combination of stability and growth potential may find KSPN stock an attractive investment option.

12.3 What are the risks associated with investing in KSPN stock?

Investing in KSPN stock involves potential risks, including market volatility, competitive pressures, and regulatory and compliance risks. Investors should carefully consider these risks when making investment decisions.

12.4 How can I analyze the performance of KSPN stock?

Investors can analyze the performance of KSPN stock by evaluating key performance indicators such as stock price trends, earnings, financial metrics, and market sentiment. By understanding these factors, investors can make informed investment decisions.

12.5 What are the growth prospects for KSPN stock?

KSPN stock's growth prospects are closely tied to the company's growth strategies and its ability to adapt to changing market conditions. By focusing on strategic expansion, innovation-driven growth, and customer-centric initiatives, KSPN aims to drive sustained growth and enhance shareholder value.

12.6 Where can I find more information about KSPN stock?

Investors can find more information about KSPN stock by accessing the company's financial statements, market reports, and expert opinions. Additionally, staying informed about the latest news and developments related to KSPN stock can provide valuable insights into its performance and potential as an investment option.

13. Conclusion and Final Thoughts

KSPN stock offers a range of investment opportunities for individuals and institutions seeking to diversify their portfolios and capitalize on growth potential. With its strong financial performance, market leadership, and strategic growth initiatives, KSPN stock presents an attractive option for investors seeking a combination of stability and growth.

However, it's important for investors to be aware of the potential risks and challenges associated with investing in KSPN stock, including market volatility, competitive pressures, and regulatory and compliance risks. By employing effective investment strategies, such as long-term investment, diversification, and regular monitoring and review, investors can maximize their returns and minimize potential risks.

In conclusion, KSPN stock presents a promising investment opportunity for those looking to capitalize on its growth potential and market leadership. By staying informed about the latest news and developments related to KSPN stock, investors can make informed decisions and achieve their financial goals.

14. Additional Resources for Investors

Investors seeking to learn more about KSPN stock and its potential as an investment option can access a range of additional resources, including financial statements, market reports, and expert opinions. These resources can provide valuable insights into KSPN's performance and potential as an investment option, helping investors make informed decisions.

14.1 Financial Statements

Accessing the company's financial statements can provide valuable insights into its financial health and operational efficiency. Investors can analyze key performance indicators such as revenue growth, profit margins, and cash flow position to assess the company's financial performance.

14.2 Market Reports

Market reports provide valuable insights into the competitive landscape and industry trends, helping investors gain a deeper understanding of the factors influencing KSPN's stock performance. By staying informed about market trends, investors can make informed investment decisions.

14.3 Expert Opinions

Considering the views of industry experts and market analysts can provide valuable insights into KSPN's performance and potential as an investment option. By understanding these perspectives, investors can gain a deeper understanding of the factors driving KSPN's stock performance and make informed investment decisions.

15. External Links and Further Reading

For those interested in learning more about KSPN stock and its potential as an investment option, the following external links and resources provide valuable insights and information.

By accessing these resources, investors can gain valuable insights into KSPN's performance and potential as an investment option, helping them make informed decisions and achieve their financial goals.

You Might Also Like

Mark Douglas: The Untold Truth Behind His Cause Of DeathMarc Bell Net Worth: An Insight Into The Financial Empire

Are Gatorade Protein Bars Good? A Deep Dive Into Their Benefits And Nutritional Value

Insights Into Eugene Flood: A Visionary's Impact On Finance And Beyond

Caley Castelein: A Visionary In Sustainable Investments

Article Recommendations

- Real Madrid Vs Atalanta Where To Watch Live Streaming Tv

- Understanding The Financial Status Of Donnie Swaggart Insights Into Wealth And Influence

- Tim Conway Net Worth A Look At The Comedic Legends Financial Success